In a changing world that is continually influenced by technology, fads and devices of convenience, health plans recognize that their customer relationships are forever evolving. Although the variables are always in motion, there is one constant that demands our focus — health plans must offer a superior customer experience.

As today’s customer service environment increasingly moves toward self-service, learning how to maintain a personal touch as we shift from people to technology is important. Although staying at the forefront of health care may seem complex, it boils down to a very simple solution — understanding the health plan members’ needs relative to the convenience they are accustomed to in virtually every other industry. With this understanding in mind, innovative solutions are the vehicle to driving member satisfaction and garnering loyalty, not to mention making a true improvement in quality of life.

The brutal truth is that most health plan members view their customer service experience as sub par, ranking last among all other major industries, according to a 2009 Forrester report, written by Elizabeth Boehm and titled “Health Plans Face a Member Experience Crisis.” As the report states, “It turns out that customer satisfaction decreases as consumers interact more with their health plan.” The report’s findings also show that members believe their “health plans make things more complicated than they need to be.”1 The question to ask is: How can we make health plan interactions easy, while providing a superior customer service experience?

IT’S AN ONLINE, SELF-SERVICE WORLD

Because we are a mobile society, information has to follow us in our busy lives and not the other way around. Although a health plan’s point of connection with its members occurs in three ways — through their online experience, call centers and mailed printed matter — it is the online experience that has become the primary focus for customer service delivery. Health plans are beginning to use the Web, mobile technology and kiosks to provide the information world to their members on their own terms.

Those of all ages have been able to enrich their lives by connecting to the online world. In fact, as we age and find our physical mobility becoming more limited, reaching out to the online world provides new opportunities for community connections. This is especially true for seniors who are learning to use online social networking as a way to find old and new friends. Instead of walking to the local coffee shop to meet friends and family, they can now chat online, thereby eliminating all physical barriers.

While the online world offers many advantages, using it to its full potential can be challenging. Creating a superior customer service experience requires skills in human factors as well as a comprehensive understanding of each audience. Health plans can realize customer service improvements by focusing their efforts on strategic, up-stream activities such as focus groups, usability testing and user experience architecture that will ultimately define the components of a superior experience.

RULES OF ONLINE USE ARE CHANGING

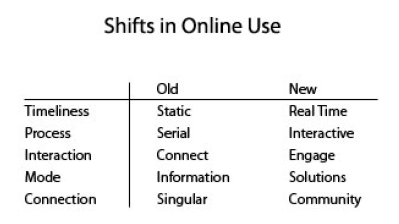

Now that health plan members are beginning to expect and even demand online options, the rules of customer service are changing. Today’s health plan member does not have the time or patience to figure out complex forms and processes. They expect access in real time, along with smart applications and dashboards, to help them make decisions. In addition, they want an interactive experience that engages them with others and immerses them in a supportive community rather than the stand-alone, impersonal pedestals of Web sites with complex navigational mazes that seem to hide information.

In other words, health plan members want a system that is easy to use, and they want to be in control. The table below shows how member expectations have changed over time:

ACTUALIZING INNOVATION

In order to drive customer service innovation, health plans need to define their many member interaction points and deploy focus groups that address the following questions:

- What do we need to improve?

- Where do we need to be?

- How do we improve production to give our members conveniences already offered by other industries?

The lessons learned from these focus groups should be used to build a better model that includes improved online communications, concierge delivery, personalized communications, mobile technology and an expanded “HealthScape.” This will lead the way to an experience that is truly in tune with the customer’s needs.

Online Communications

What can health plans do to improve online communications? Hide the complexity by focusing on audience-centered design and create a simple user interface. This essential step can be accomplished by re-thinking processes in a way that transforms them into a customer point-of-view. Look at the logistics of building your online sites by using a “shopping mall” model that allows for entry at one portal and gives access to many areas. Combining the ports of entry into one area reduces the risk of a fragmented experience.

Navigating through an online maze is the number one frustration for users in all industries. In fact, customers would prefer to take many easy steps to gather information rather than a few difficult steps. Think of an encyclopedia as your model. Although you usually cannot get to a subject in two turns of a page, having the proper topology and guidance system makes it easy to find the information you need.

Concierge Model

Many hotels offer a superior customer service experience by using concierge services. They do not expect their customers to know how to find their way in a new town, who to call for reservations or how to use the hotel’s facilities. Concierge services are provided as a guide for navigating through unknown or complex structures.

Both outsiders and insiders often view their health plan as a complex structure; however, a self-service concierge model can be designed to navigate through this complexity. For example, customer service can take away the logistics issues that members suffer through when encountering a health event. If there is a hospital located many miles away that provides better quality for a better price, then the health plan should provide travel services so the member can focus on what is important to them — their health — and not on making travel arrangements. Taking logistic pain points out of the process enhances the customer service experience during a stressful health event.

Personalized Communications

Offering personalized communications as a standard across all platforms is a best practice in other industries and should be a standard practice for health plans as well. Enrollment forms, plan summaries and physician directories should include member information and data to assist in the decision making process. A personalized document is more appealing and garners better responses than a standardized form letter.

Some payers, such as Regency Blue Cross Blue Shield, no longer send out a traditional Explanation of Benefits. They have replaced them with easy-to-understand and personalized health statements embedded with marketing information. This communication now serves as an engagement tool that is useful to the member while providing an opportunity for the plan to sell additional services.

Mobility Anytime

Some estimates show that up to 50 percent of people will have smart phones within one year. Whether standing in line, traveling or waiting for children to finish school activities, people want the ability to connect online in real time. Health plan tools should take advantage of this technology and make smart applications available that enable members to easily manage their care.

Additionally, kiosks have been a major self-service delivery point in the banking industry for many years. Conveniently located, easy to use and available at all hours, customers love the convenience. Kiosks also entered the health care space a few years ago, offering applications such as way-finding and registration. Now is the perfect time for health plans to expand their kiosk capabilities by offering new, focused smart applications.

The HealthScape is Expanding

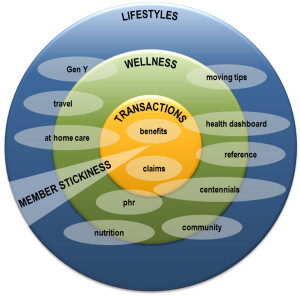

Health plans can no longer afford to limit their online customer service offerings to just health events and transactions. As health care priorities shift, members who previously used their plan’s Web site to find a new provider or review a claim now want the ability to do more. In fact, there is a need for a new term that encompasses all of the moving targets demanded by today’s consumers. HealthScape is a new term encompasses the three segments of a successful health plan Web site:

- Health Events and Transactions

- Wellness

- Lifestyles

The primary challenge for health plans is to tie together all three segments into a uniform, connected Web site that provides a superior customer service experience for increased loyalty.

The following diagram shows the information that should be provided within each segment of the HealthScape:

HealthScape

Many Web sites began by providing member services in the health events and transaction segment of the HealthScape. Inquiries pertaining to claims, providers and benefits are the most utilized features of this segment. However, with the increasing popularity of HSA and HRA plans that are designed to lower costs by motivating members to stay healthy and follow wellness guidelines, some plans are adding wellness and lifestyle segments to their Web sites in order to provide a more robust user experience.

The wellness and lifestyle segments of the HealthScape can be linked through a variety of shared experiences. For example, when evaluating data aggregation, health plans can provide their members with high-tech wellness tools such as the Nike Triax Elite, pedometers, the Health Buddy, GlucoPhone, blood pressure monitors and a myriad of other devices designed to acquire personal health information. The health plan can then aggregate this data and make it available online so members can monitor their fitness and make any necessary lifestyle changes. The health plan can also offer incentives based on the member’s progress.

Another HealthScape experience that crosses multiple segments is “at home care.” This type of care increases quality of life while decreasing hospital costs. For example, at home care for diabetes includes the use of equipment to monitor blood sugar levels and medication delivery to patients while in the comfort of their home. Uploading the test results to an online portal offers the opportunity for physician review while results can be made available to the member.

A population that will play an increasingly important role in the HealthScape is that of the Millennials, also known as the “ME” generation. This group, ages 18–29 years old, numbers between 80 and 95 million. They work hard, play hard and consider their lifestyle when making health care decisions. In fact, they will even schedule business events to fit in with their lifestyle, such as scheduling a business meeting around a yoga class.2 The Millennials know their priorities and, as young people, they are tech savvy, “always on” and only take “yes” for an answer. Given their youthful feelings of invincibility, the wellness and lifestyle segments of the HealthScape are their primary areas of focus. An incredible opportunity exists for health plans to provide them with advice on nutrition, healthy living, traveling and more.

As the use of health plan Web sites migrates from health transactions and events to wellness and finally to lifestyles, the HealthScape becomes “stickier” and member retention becomes less of a problem. The plans that limit their Web sites to health events and transactions will only have members visiting their site a few times each year. With such low interaction, retention is difficult because so many alternatives for information exist elsewhere and members will gravitate toward plans with more informative Web sites. However, by providing a well-designed HealthScape, members will visit more often to seek advice and participate in healthy living programs. This, in turn, promotes a higher quality of life and lower health costs.

TRANSFORMATION

Convenience, simplicity and robustness are the building blocks of a superior online experience. As in virtually every other industry, health plan members have become savvy users of technology. Health plans must transform their approach to customer service and remove the current disconnect between customer service and technology and focus on making online customer service easy to use while improving functionality and content.

The challenge? The challenge is creating a “big picture,” self-service platform that satisfies member needs while providing a rich online experience. The bar for customer service has been raised, and plans should view this time as an inspirational turning point or risk missing the opportunity to truly enhance the lives of their members. In fact, the health plan customer service experience should be designed with the following motto in mind: Partners for Life.