The traditional interaction with payers has been around transactions. Find a doctor, pharmacy, look up my benefits, and look up a claim. This is a transaction layer in the consumer relationship. There is little opportunity to develop a relationship and generate consumer stickiness in this area. Consumers only go to the transaction layer to perform a transaction, which in a large payer, is about one to two times a year. The main reason that many members perform a transaction is because they are going through a health event, such as a sickness or medical condition, so members are already in a stressed state dealing with a personal or family health issue. Not the best time to generate a relationship. The best way a payer can generate a positive experience in this layer is to provide superior support for the member when needed. This translates to a flawless experience by offering a caring connection, managing administrative tasks and processes, and performing event logistics so members can focus on their health. To build productive relationships, payers need to go where the people are and when they are in a good state of mind.

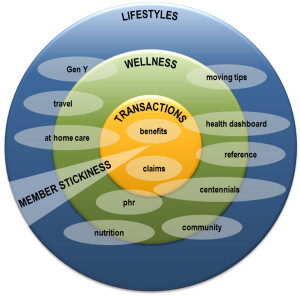

The diagram below shows a representation of the HealthScape from a consumer perspective. There are three distinct layers around health and consumer involvement with the transaction layer being at the core. They are different in how often members interact in each layer.

HealthScape

In the transaction layer, people may interact several times a year with a payer performing a health transaction. In the wellness layer, people interact far more often such as one to two times a week depending in their personal plans for nutrition and exercise. In the lifestyle layer, there is potential for people to be involved in health everyday as it becomes part of a routine in a person’s daily living. In the lifestyle layer, a payer has the potential to achieve relationship nirvana – stickiness.

In the wellness layer, members are focusing on keeping, or getting to, a state of wellness. The big issues on their minds are nutrition, exercise, and healthy behaviors. They are focusing on their health to minimize the risk of being sick and to lead a productive life. The member starts to enter into a relationship with wellness providers and coaches to engage in healthy behaviors. Telephone coaching is an example of this. Wellness is one of many personal priorities a member manages so it may not be the top priority every day and throughout the day. For wellness to be embraced, a member needs to absorb a healthy thinking into their life on a daily basis; it has to be part of their lifestyle.

In a lifestyle layer, people interact, work, play and experience life every day. An example of health in the lifestyle layer, is the new devices that monitor our activity, sleep and nutrition. The Jawbone UP and Fitbit Flex are wearable devices providing biometric data to consumers throughout the day. The devices provide feedback to adjust consumer’s actions and behaviors in order to reach their desired goals. These devices are part of the wearer’s lifestyle and that lifestyle changes based on feedback they provide. If a person is at an office and sitting at a desk too long, an alarm goes off to let the wearer know they need to more active and move around. If this happens often, thinking is changed and a behavior formed leading to healthy outcomes.

Solutions in the lifestyle layer focus on supporting consumers in their quest for sustained healthy living.. It is important to help people approach health in a holistic manner and offer encouragement and tools in the areas of nutrition, exercise, stress, care, community, and healthy habits. Relationship maturity can blossom in the lifestyle layer. To assist payers in their vision to diversify, they can find opportunity in the lifestyle layer by offering tools to reinforce healthy behaviors and be more than providing health plans. The definition of health to a payer is about healthy living for members and not just paying a claim.

The same occurred in the banking industry. Years ago, banks just performed transactions such as deposit a check. Now banks offer rounded services such as financial planning for retirement, college, and family growth supporting a person throughout their life; supporting their lifestyle.

An extension of a payer’s offer could be to aggregate data from multiple biometric devices and offer services to their members such as a health dashboard with relevant content to support decision-making and behavior changes in pursuit of healthier living. As I mentioned under the engagement section, healthy behaviors lowers the causes for chronic diseases, which lowers medical costs in health care.